Just as you shape your business strategy, managing your personal finances is imperative for long-term success. As an entrepreneur, understanding the intricate balance between personal and business expenditures can significantly impact your financial health. In this post, you’ll discover key tips designed to help you navigate the complexities of personal finance while ensuring your entrepreneurial journey remains fruitful and sustainable. By implementing these practices, you can set a strong financial foundation that supports both your personal goals and business ambitions.

Understanding Personal Finance

While managing a business, it’s vital to grasp the fundamentals of personal finance. This knowledge can influence your decision-making, ensuring that both your personal and business finances remain healthy. By understanding income, expenses, savings, and investments, you can create a balanced financial life that supports your entrepreneurial endeavors.

Importance of Financial Literacy

Behind every successful entrepreneur lies a strong foundation of financial literacy. Being financially literate empowers you to make informed decisions about budgeting, investing, and managing debt. This knowledge not only helps you grow your business but also fosters confidence in your financial journey, allowing you to navigate challenges and seize opportunities.

Key Financial Terms Every Entrepreneur Should Know

To effectively manage your finances, familiarize yourself with key financial terms. Understanding concepts such as cash flow, profit margin, and return on investment is crucial for assessing your business’s financial health and making informed decisions.

Even a basic grasp of financial terminology can dramatically impact your ability to navigate the world of entrepreneurship. Terms like liquidity help you understand your ability to cover short-term expenses, while equity gives insight into your ownership stake in the business. Mastering these terms enhances your financial communication, ensuring you engage meaningfully with accountants, investors, and partners. Prioritizing financial literacy is an investment in your entrepreneurial success.

Budgeting Strategies for Entrepreneurs

Assuming you want to build a successful business, implementing effective budgeting strategies is necessary for managing your finances. A well-structured budget not only helps you identify your sources of income but also allows you to allocate funds wisely, ensuring you can cover expenses while still investing in growth opportunities. By setting clear financial goals and regularly reviewing your budget, you can maintain financial stability and make informed decisions for your business.

Creating a Comprehensive Budget

Before entering into your budget, take the time to gather all financial information, including past income, recurring expenses, and future projections. A comprehensive budget should account for all aspects of your business, from fixed costs like rent and salaries to variable expenses like marketing and supplies. This level of detail ensures you have a clear picture of your financial landscape and can plan accordingly.

Tracking Income and Expenses

Against the backdrop of a well-structured budget, keeping a close eye on your income and expenses is vital for your financial health. Regularly monitoring these figures allows you to identify trends, recognize potential problems early, and adjust your spending habits as needed to stay on track with your financial goals.

Understanding how your income and expenses fluctuate can empower you to make proactive financial decisions. By utilizing tracking tools, such as spreadsheets or accounting software, you can categorize your expenditures and analyze your cash flow effectively. This ongoing process will help you spot discrepancies and provide insights into areas where you can cut costs or increase revenue, ultimately supporting your long-term business aspirations.

Building and Maintaining Credit

Now that you’re starting your entrepreneurial journey, it’s vital to build and maintain a strong credit profile. Your creditworthiness affects your ability to secure loans, negotiate better interest rates, and manage business expenses. Establishing a solid credit history ensures that you have access to necessary financial resources, enabling you to grow your business and navigate challenging times effectively.

Understanding Credit Scores

After launching your business, it’s crucial to grasp the intricacies of credit scores. Credit scores typically range from 300 to 850, and they are influenced by factors like payment history, credit utilization, and the length of your credit history. A high score demonstrates reliability to lenders, while a low score can limit your access to financing and increase costs.

Tips for Improving Your Credit Rating

Improving your credit rating can open doors to better financial opportunities. To enhance your score, consider the following strategies:

- Pay your bills on time to maintain a positive payment history.

- Keep your credit utilization below 30% of your total credit limit.

- Avoid opening multiple new accounts at once to minimize hard inquiries.

- Regularly check your credit report for errors and dispute any inaccuracies.

Perceiving these steps as a regular part of your financial management can significantly boost your credit rating.

Hence, enhancing your credit rating requires consistent efforts and informed actions. You can implement further strategies, such as:

- Maintaining old accounts to lengthen your credit history.

- Mixing your types of credit, including revolving credit and loans.

- Avoiding closing unused accounts that contribute positively to your credit age.

- Utilizing credit responsibly, allowing for small charges that you pay off each month.

Perceiving credit management as an ongoing process will empower you to achieve financial health and stability for your entrepreneurial endeavors.

Tax Planning and Deductions

Unlike traditional employees, you have the unique opportunity to leverage various tax planning strategies to reduce your taxable income. It’s important to stay informed about tax regulations that affect your business and take advantage of deductions specific to your industry. By proactively managing your tax obligations, you can allocate more resources towards growing your enterprise.

Essential Tax Deductions for Entrepreneurs

Essential tax deductions for entrepreneurs include expenses related to your home office, business travel, and professional development. Additionally, costs incurred for supplies, marketing, and even certain meals can significantly reduce your taxable income. By staying organized and keeping track of your expenses, you can maximize your deductions and improve your bottom line.

Strategies for Effective Tax Planning

The foundation of effective tax planning lies in understanding your financial landscape and identifying opportunities for deductions. You should regularly review your income, expenses, and tax liability in order to adapt your strategies as your business evolves.

For instance, consider setting up a separate bank account for your business transactions to streamline record-keeping and ensure that all eligible expenses are captured. This practice not only simplifies your accounting but also helps you stay disciplined in tracking expenses throughout the year. Additionally, consulting with a tax professional can provide tailored insights and strategies, ensuring that you remain compliant while maximizing deductions specific to your entrepreneurial activities.

Investing in Your Business

Keep in mind that investing in your business is necessary for growth and sustainability. As an entrepreneur, allocating funds wisely can enhance your operations, improve your brand, and set you up for long-term success. It’s vital to explore various investment options that align with your business goals and seek out opportunities that promise good returns.

Types of Investments for Entrepreneurs

After identifying the areas that need investment, you can evaluate the types of investments available to you:

| Investment Type | Description |

| Equipment | Upgrading tools or technology to enhance productivity. |

| Marketing | Investing in campaigns to broaden your reach. |

| Training | Providing educational resources for your team. |

| Research & Development | Innovating new products or services. |

| Real Estate | Purchasing or leasing properties to establish your presence. |

After considering these options, you can prioritize where to allocate your funds based on potential impact and expected returns.

Assessing Risk and Return

Assessing risk and return is vital in investment decisions. Every investment comes with its level of risk, and understanding these risks will help you make informed choices that suit your risk tolerance and business strategy.

Another important aspect is to analyze the potential returns on your investments. You should assess how much profit you expect to generate and the likelihood of achieving those returns. This process requires a thorough understanding of market conditions, competitor analysis, and your business’s capacity. Balancing risk and return effectively allows you to make sound investment decisions that foster growth while minimizing potential losses.

Retirement Planning for Entrepreneurs

Once again, as an entrepreneur, it’s vital to prioritize your retirement planning just as you do your business growth. Having a clear retirement strategy ensures you have the financial stability to enjoy your later years. Unlike traditional employees, you must take the initiative to set aside funds that can grow over time, securing both your future and your peace of mind.

Importance of Early Retirement Planning

Behind your business strategy lies the importance of establishing a solid retirement plan early on. It allows you to take advantage of compounding interest and tax benefits that can significantly enhance your savings. The sooner you start, the easier it becomes to accumulate the funds you’ll need for a comfortable retirement.

Retirement Savings Options for Business Owners

Options available to you as a business owner for retirement savings include plans like SEP IRAs, Solo 401(k)s, and SIMPLE IRAs. Each of these offers distinct advantages tailored to your situation, allowing you to maximize contributions and minimize taxes effectively.

In addition to the aforementioned plans, you can also explore traditional IRAs and Roth IRAs. Each option provides different tax benefits and limits on contributions, so consider your income level and tax situation when choosing. It’s advisable to consult with a financial planner specialized in retirement strategies for entrepreneurs to ensure you select the best option for your unique needs and goals.

Conclusion

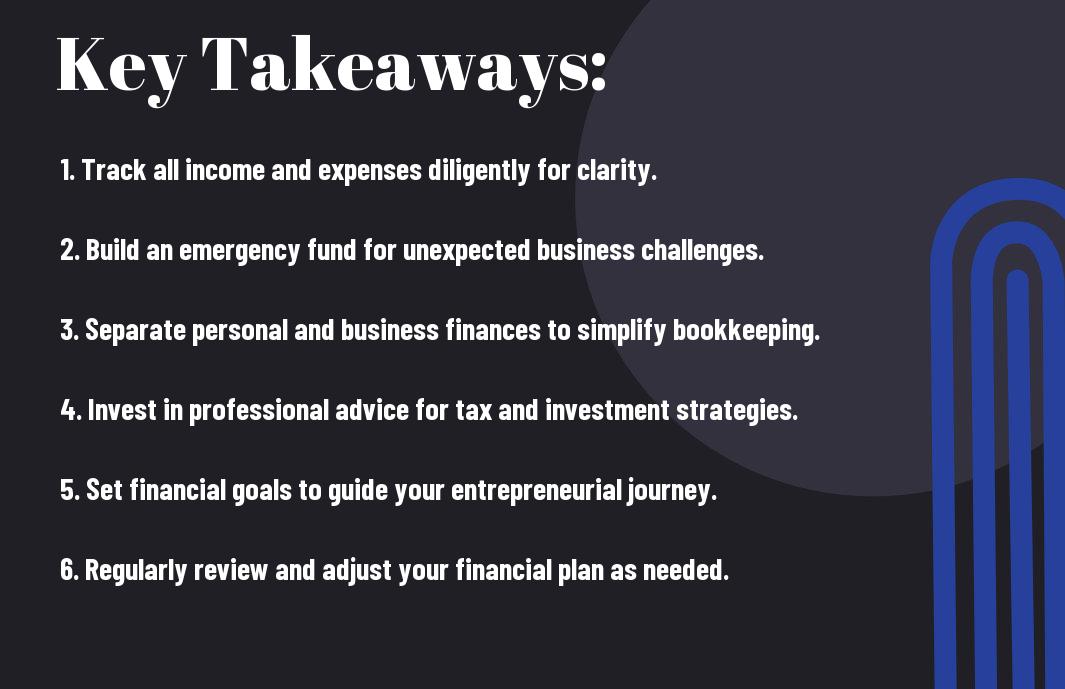

So, as you navigate the entrepreneurial landscape, applying these personal finance tips can significantly enhance your financial health and business success. By managing your cash flow, budgeting effectively, and investing wisely, you empower yourself to make informed decisions. Additionally, understanding taxes and maintaining accurate records will help you avoid common pitfalls. Take charge of your financial journey to ensure a prosperous future for both your business and personal life.

Leave a Reply